The importance of the web development industry can hardly be overstated: the infrastructure that web developers build enables all companies and individuals to realize their ideas — from the largest commercial successes to the most dedicated nonprofits. This hard work pays well, but without proper financial planning, even a web developer’s salary can feel somewhat low. A good start would be monitoring your income and expenses plus budgeting — and this article will guide you through the best solutions.

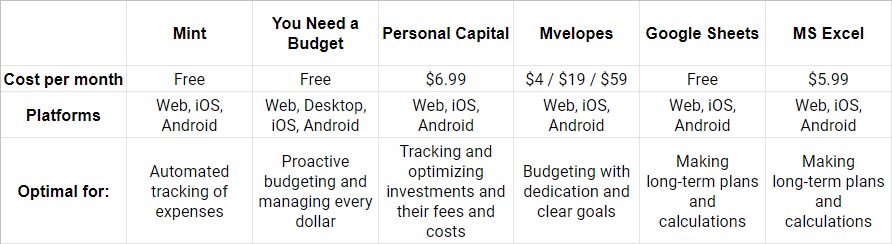

Just like renting movies or signing documents, the process of tracking expenses has also gone digital — nowadays, you can grab your favorite coffee and have your mobile phone seamlessly process this transaction and sort it in the “Groceries” category. Automating user’s expenses is such an in-demand feature that we now have a myriad of similar services to choose from — and the variety may be confusing! In this article, we’ll examine the most popular budgeting & financial planning solutions: we’ll study their key features, pros, and cons; we’ll compare them based on different criteria; finally, we’ll provide you with a spreadsheet detailing each service — so you’ll know what works best for you.

How can these tools help us?

You may be inclined to trust your good old budgeting notepad more, preferring to write everything down and store it somewhere safe. However, the services we’re going to discuss offer some great functionality (besides the obvious like tracking expenses) which will hopefully address questions like “Well, why use them at all?”

• Protection against fraudulent activity. It’s not unusual nowadays to have multiple accounts, all of which can have direct access to your money and each can be a potential target for frauds. By linking all accounts to a single service, you can monitor their activities at the same time — this may save you precious hours (or minutes and seconds) when an account’s been compromised.

• Generate reports and visualize. A picture is worth a thousand words — and a bar chart comparing how much money you spent on eating out vs. how much money you saved is indeed a powerful visual.

• Track net worth. A sound financial foundation is built via incrementing steps. Taking these little steps a day in and day out, you may feel that you aren’t really achieving any progress — but as you track the changes in your net worth, you appreciate the right path you’ve chosen.

Mint

![]()

A go-to budgeting solution for more than 15 million users, Mint is a solid pick when it comes to organizing your finances. A quick look at the service’s key features is enough to know why: Mint allows you to track both your income and expenses and set up a budget if you feel that certain spending categories are getting out of hand. Mint’s automated categorization sorts each transaction in its own category and visualizes your spendings in real time. Even running late with your bills shouldn’t be an issue — Mint can be set up to remind about them on a regular basis. For even more control over spending, you can set up personalized alerts to warn you about going over your budget.

However, some of Mint’s functionality often backfires, creating hassle instead of resolving it: transactions may be categorized incorrectly, forcing the user to edit them manually. Doing this via a mobile interface (Mint’s mobile apps offer more functionality than the web version) is… well, let’s just say it would be easier to pretend this transaction never happened. Users have also reported synchronization issues between Mint’s mobile and web apps: some people prefer to check their financial updates in the evening, in the comfort of a computer display… only to learn that there’s nothing to check — services haven’t synced yet.

Best used for: passively tracking your expenses and bills.

You Need a Budget

![]()

Unlike Mint and its passive approach, YNAB really makes the user feel responsible. Providing online classes on financial literacy (covering topics like budgeting 101, debt, smart use of credit cards) through their website, YNAB encourages its users to be proactive when it comes to managing their finances and be informed about possible pitfalls of overspending. The team behind the service reinforces the “4 Rules” strategy which can help users spend smarter (or less):

1. Give every dollar a job: spend money based on a given category’s budget, not your overall budget. This way, you’ll see that eating out for $100 doesn’t really fit your $50 eating out limit.

2. Save for a rainy day: understand the importance of an emergency fund and build it as soon as possible.

3. Roll with the punches: if overspending occurs — alright, it happens! Simply adjust your budget and carry on.

4. Live on last month’s income: spend this month, what you earned last month thanks to saving.

The service utilizes these principles to help you build your budget and stick to it no matter what happens. Although YNAB does offer automated paycheck & bill payments, it still expects the user to be responsible for assigning spending categories and uploading the transactions — all manually, so for some users, this may be too time-consuming.

Best used for: creating a strict budget and following it.

Personal Capital

![]()

Besides expenses and budgets, it’s worth remembering that your financial situation is also dependent on your assets and investments: your car, your home, your Apple stock (if you didn’t happen to sell it after the company’s last earnings report). Once your investments start to pile up, it may be hard to keep track of all costs associated with them: management and account fees, portfolio and net worth changes, account balances and bills. Personal Capital takes this hassle away by providing all relevant information about your assets and investments and how you can optimize them.

As the service focuses on investments that barely need to be micromanaged, its budgeting solutions may seem rudimentary compared to those of other services — after all, tracking small expenses is hardly the focus. For more active management of spendings, you may want to look at services like Mint or YNAB. Also, Personal Capital’s monetization model forces to be constantly offering users their investment management fees once the user’s account net worth reaches $100k — which some people may find too intrusive.

Best used for: tracking investments and lowering costs associated with them.

Mvelopes

![]()

Mvelopes offers a budgeting solution with a twist: dividing your expenses into envelopes and spending accordingly. The envelopes can refer to any category of spendings you currently have: rent or mortgage, groceries, debt repayment, entertainment, investing and so on. Once an envelope is emptied out, spending in this category should be restricted. Mvelopes asks the user to define their financial goals from most to least important: a student, for instance, would be focused on aggressively paying their student loans off. This system enables you to reach your financial goals and milestones easier and faster.

However, planning via the envelopes method requires a great deal of dedication and discipline from the user’s part: you need to set your financial priorities straight and follow them rigorously. Occasional splurges on living life above one’s means are out of the question: an empty envelope means “No!” and there’s no workaround.

Best used for: budgeting with clear goals in mind.

Google Sheets or Microsoft Excel

![]()

A duet of unusual contenders: Google Sheets and MS Excel. Wait a minute — didn’t we say that cumbersome ledgers were a thing of the past? Indeed, their interfaces may be intimidating at first, but their power lies in crowdsourcing: people can share their templates for others to see, use and improve. Over time, the community of personal finance enthusiasts has gathered a plethora of these refined solutions — they range from simple budget spreadsheets to complex retirement calculators (solutions so complex they may very well shine in a python programmer resume). Also, both Sheets and Excel provide out-of-the-box budgeting templates.

Best used for: tailoring your spreadsheets to fit your needs and utilizing complex formulas.

Disclaimer: it’s not unusual for services to change their plans and fees — which may render our neat spreadsheet obsolete. You know what would be awesome? Reaching out to us via Twitter → reminding us to update it → profit!

Case 1: I don’t have a lot of time on my hands to track my expenses manually. I’d rather let the service manage my bills and alert me if I overspend. What should I use?

Answer: A good pick would be Mint, but remember: Mint Bills cannot automatically pay your bills anymore. For this task, you can choose YNAB.

Case 2: I have a number of investments and I feel that the fees of managing them are too high.

Answer: You can try Personal Capital and see if other brokers offer lower fees.

Case 3: I need to create a budget for my family to pay our student loans and manage other expenses.

Answer: Mvelopes will aid you with debt repayment, helping you allocate as much money as you can into this category; YNAB will take care of each family member’s spendings.

Even though the number of financial tools available today may seem overwhelming, we can simply ask ourselves: “What do I need help with?” and everything becomes clear: there are services for tracking expenses, for budgeting, for investment management and so forth. Now it’s time to try any of them and start managing your finances smarter.

Still, we can’t shake the feeling we might’ve missed something. Hint: the comment section is a great place to correct mistakes (if any) and share your knowledge — maybe one day we’ll compile a whole compendium from the stories you’ve shared!