In today’s competitive business landscape, securing funding is a critical milestone for startups aiming to transform innovative ideas into viable enterprises. As entrepreneurs embark on this journey, navigating the complex terrain of investment options can often be daunting. Understanding the nuances of funding strategies not only enhances the chances of attracting investors but also establishes a solid foundation for sustainable growth. This article delves into strategic approaches to securing startup funding successfully, offering insights and best practices that empower entrepreneurs to present compelling value propositions. From identifying the right funding sources to crafting persuasive pitches and building solid relationships with investors, we’ll explore key tactics that can elevate a startup’s funding journey and lay the groundwork for long-term success. Join us as we dissect the strategic frameworks and actionable strategies essential for unlocking the financial resources necessary to turn visionary projects into thriving businesses.

Table of Contents

- Identifying the Right Funding Sources for Your Startup

- Crafting a Compelling Business Plan to Attract Investors

- Building Relationships and Networking with Potential Funders

- Leveraging Financial Metrics and Data to Secure Investor Confidence

- To Conclude

Identifying the Right Funding Sources for Your Startup

When embarking on the journey to secure funding for your startup, it’s essential to pinpoint sources that align with your business model and long-term vision. Different types of funding can suit varied needs, whether you’re seeking early-stage investment or preparing for scaling. Consider the following options:

- Bootstrapping: Relying on personal savings or revenue generated from the business.

- Angel Investors: High-net-worth individuals who provide capital in exchange for equity.

- Venture Capital: Firms that manage pooled funds to invest in high-growth startups.

- Crowdfunding: Raising smaller amounts from a large number of people, typically through online platforms.

- Government Grants: Non-repayable funds provided by government agencies to support innovative projects.

To make an informed decision, evaluate each funding source based on criteria such as funding amount, control implications, and the level of ongoing involvement you desire. A comprehensive assessment could be structured in a table for easier comparison:

| Funding Source | Typical Amount | Control Impact | Involvement Level |

|---|---|---|---|

| Bootstrapping | Low to Medium | High | Minimal |

| Angel Investors | Medium | Moderate | Advisory |

| Venture Capital | High | Significant | Active |

| Crowdfunding | Variable | Low | Minimal |

| Government Grants | Medium to High | None | Minimal |

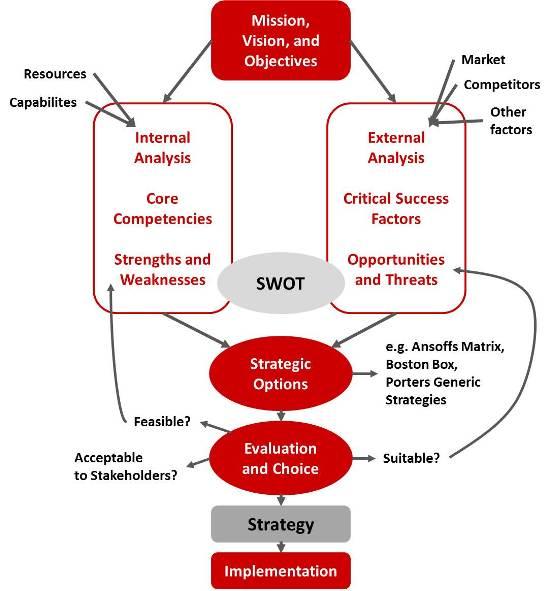

Crafting a Compelling Business Plan to Attract Investors

To captivate potential investors, a business plan must go beyond mere figures and projections; it should tell a compelling story. Start by articulating a clear vision and mission that resonates with your audience, illustrating not only what your business does but also its purpose and impact. Include well-researched market analysis that demonstrates your knowledge of industry trends, target demographics, and competitive landscape. Use visual aids like charts to present this data effectively. Furthermore, a concise executive summary should encapsulate the key aspects of your business, ensuring it intrigues investors enough to delve deeper into the details.

Your operational and financial sections are crucial in establishing credibility. Clearly outline your business model, indicating how you plan to generate revenue. Integrate realistic financial projections, including profit and loss forecasts, cash flow statements, and break-even analysis, to reassure investors of your startup’s viability. Additionally, don’t shy away from presenting potential risks and challenges—acknowledging these upfront will enhance your credibility. A well-structured, professionally formatted table can breakdown your financial projections, offering clarity at a glance:

| Year | Revenue | Expenses | Profit |

|---|---|---|---|

| Year 1 | $50,000 | $30,000 | $20,000 |

| Year 2 | $75,000 | $40,000 | $35,000 |

| Year 3 | $100,000 | $50,000 | $50,000 |

Building Relationships and Networking with Potential Funders

Establishing meaningful connections with potential funders is essential for any startup seeking financial support. Building relationships requires a proactive approach, grounded in authenticity and mutual benefit. Start by identifying the right individuals or organizations that align with your mission and values. Attend industry-specific events, workshops, and networking sessions to engage with potential funders face-to-face. Utilize platforms like LinkedIn for targeted outreach, crafting personalized messages that highlight common interests. Consider the following strategies to deepen these connections:

- Follow-up consistently: After meeting, send a thank-you message or additional information about your startup.

- Share valuable insights: Provide updates or share relevant articles that may interest your contacts.

- Offer help: Assist funders with their projects to establish a reciprocal relationship.

Moreover, nurturing these relationships over time can lead to impactful opportunities. Create a database to track your interactions, keeping notes on preferences and discussions to personalize future engagements effectively. A well-structured plan will help you manage your outreach efficiently. Consider using the following table to summarize and categorize potential funders:

| Funder Name | Sector | Interest Areas | Last Contact Date |

|---|---|---|---|

| Venture Corp | Technology | AI, Blockchain | 08/15/2023 |

| Green Fund | Sustainability | Renewable Energy | 07/10/2023 |

| Health Innovations | Healthcare | Biotechnology | 06/25/2023 |

Leveraging Financial Metrics and Data to Secure Investor Confidence

In an increasingly competitive landscape, illustrating your startup’s potential through robust financial metrics is paramount. Investors gravitate towards quantifiable data that encapsulates the viability and growth potential of your enterprise. By utilizing key performance indicators such as Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Burn Rate, you can offer a comprehensive snapshot of your business model. Furthermore, presenting data trends over time can bolster confidence, showcasing not only where your startup currently stands but also where it is headed.

A succinct and clear financial narrative, underscored by visual aids such as charts and tables, can significantly enhance investor engagement. Displaying projections against historical data fuels trust and indicates strong financial stewardship. Consider organizing your data in a structured table format, emphasizing key comparisons and appealing metrics:

| Metric | Current Value | Projected Value (Year 1) | Growth Rate |

|---|---|---|---|

| Customer Acquisition Cost (CAC) | $150 | $120 | 20% |

| Lifetime Value (LTV) | $600 | $750 | 25% |

| Monthly Burn Rate | $10,000 | $7,500 | -25% |

This level of analytical detail not only fosters transparency but also articulates your commitment to strategic financial management. By embedding these metrics into your funding pitch, you position your startup as a willing partner in a data-driven dialogue, essential for securing investor confidence and enhancing funding prospects.

To Conclude

navigating the intricate landscape of securing funding for your startup demands a well-crafted strategy and keen understanding of the investment ecosystem. By leveraging a combination of thorough market research, networking, and a compelling pitch, founders can enhance their appeal to potential investors. Furthermore, embracing adaptability and maintaining a clear vision for your business will not only foster investor confidence but also position your startup for sustainable growth. As you embark on this journey, remember that every interaction counts; cultivating relationships and demonstrating resilience may ultimately prove more valuable than the funding itself. With the right approach, you can turn your innovative ideas into reality and build a thriving enterprise. Invest in your preparation, and success will follow.