A buzzword often associated with a remote worker’s lifestyle is “freedom” — freedom to go anywhere and work from any part of the world. Remote workflow often means easier relocation opportunities: lives of office employees are stained by longer commute, worse ecology, or need to reside in neighborhoods associated with high costs of living. Feeling the temptation of a digital nomad lifestyle, they dive into a form of “financial downshifting”, cutting their expenses and saving more aggressively.

As remote professionals focus on improving their hard and soft skills, the skill of managing money correctly often falls by the wayside. Financial freedom, a direct result of good financial planning, is often overlooked and neglected, but why should that be the case? Despite the vast logistical differences between remote and office workers, financial planning is equally important to both of these groups. Hopefully, the frequency of “Upvote this money cat to become a rich web developer” posts will then decrease! Speaking of money cat posts, though…

Setting goals

It’s obvious that these posts are fun, but their popularity signifies not-so-amusing statistics: people put financial planning off until it’s too late. One of the reasons behind this problem is the perceived complexity of managing your money: after all, there’s even a job called “Financial planner”, so it must be hard, right?

Actually, once we break our financial flow into a system of “income — spending — saving” and set goals aiming to better our situation, everything becomes more clear. After all, we are goal-oriented creatures: a neurotransmitter called dopamine drives us to set goals and achieve them. This process of reaching the point you’ve been aiming at has proven really useful: you could argue that we wouldn’t have had the technology of writing blog posts otherwise. Neat! So we can organize our lives in a meaningful way and have a sense of progress throughout all of it. Come to think of it, planning your life isn’t that different from developing software: we turn a massive abstract idea into a set of achievable tasks, then perfect the system over time.

This is where two schools of thought clash: some people believe that planning well into the future (10, 15, 20 years ahead) is possible; others prefer shorter timeframes (1, 3, 5 years). The goals you set in your personal or professional life will strongly correlate with the financial ones. Here comes the tricky part: not allowing financial goals take control of your life. This may sound like a clichéd “money isn’t everything” idea, so let’s break it down: money is important (hence this article), but its importance lies in the ability to help us fulfill our goals. Despite our mind’s attraction to raw numbers, a goal like “1 million dollars at the age of 30” may prove to be unfulfilling if there’s nothing substantial (a meaningful career, a close relationship) to back it up.

Being SMART

This means we can utilize the SMART system to set financial goals — this way, we’ll focus on what we’re aiming to achieve both in our life and financial situation. The SMART system suggests that a goal shouldn’t be an abstract idea we create to feel better about ourselves (e.g. “My New Year resolution is becoming a better person!”), but rather a concrete pathway from Situation A to Situation B. This pathway has 5 qualities which make the goal real and possible to achieve: Specific, Measurable, Assignable, Realistic, Time-bound. Although the meaning of these qualities may seem self-evident, there’s great wisdom behind each of them — wisdom which we will now explore.

Specific

So many goals have fallen victim to being vague: a goal that is unclear doesn’t really put any pressure and only hints at something. To avoid this, we need to make our goals specific by asking five “w” questions:

What: What is the result we’re aiming at? What are we trying to create, learn, accomplish? This can range from something grand (like completely repaying a debt) to something simple (like quitting a bad spending habit)

Why: Why is it important? Why this goal and not any other one? This question addresses the connection between your personal life and its financial counterpart, checking if we really mean it when we say it.

Who: Who is involved? Who can help us realize this goal? Certain goals may be dependent on the people around you — they can help you overcome obstacles (unfortunately, it’s also vital to keep those who only create obstacles at bay)

Where: Where is it going to happen? Where will we be working at it? For some goals, it’s important to understand that they can only be carried out in specific places: when it comes to advancing your career, for instance, relocating to a more economically developed area is a must.

Which: Which attributes are important? In this part we think about any conditions or restraints our goal may have.

Measurable

Having thoroughly defined the goal, we then move on to analyze its criteria for success: in many instances, we may need to check if we’re making any progress at all — is the net worth increasing? Are unnecessary spendings going down? As financial planning involves numbers, measuring how to reach the goal harmonically fits with questions like…

How much? How many? Remembering the system’s Specific part, we set a concrete number that we’ll judge our goal by: it can be static (“I want to save $10k) or dynamic (“Each month I’ll decrease the amount of money I spend on streaming services by 5%”).

It’s tempting to pick a number and try to stick to it no matter what happens; it would be wiser, however, to adjust your number (every month or every quarter) according to your life situation — as life conditions change, so will your number. Here’s a good example: relocating from the Midwest to California and trying to preserve the same savings rate percentage probably won’t work. The number shouldn’t be the master of your personal life — instead, it should be a reflection of it.

Achievable

Many goals have also failed due to their grandiosity: although specific and measurable, they couldn’t stand the test of reality because they just couldn’t be achieved. Such a goal can be caused by different factors: not enough research (therefore overestimating one’s capabilities) or not enough justified skepticism (therefore aiming to be the king of the world). Now, it’s important that we highlight this idea: people should dream big. However, we like to attribute the success we see to once-in-a-lifetime, life-changing events — and ignoring the fact that success is built by smaller instances of dedicated work. Thus, “Becoming the richest person in the world” is barely an achievable goal, but “Dividing your life into smaller goals and consistently working to improve them to become the richest person in the world” may just work.

Realistic

Although “Achievable” and “Realistic” may sound similar, there’s a reason for putting this criterion in the SMART system. We interpret this part as one having relation with your personal goals: that means putting the “meaning first, money second” idea in motion. A realistic goal takes all factors into account: not only your financial situation but also how it can improve the quality of your life and make you better and smarter. For example, trying to save all of your post-expenses income is achievable, but that would mean no entertainment, socialization, education or hobbies — and these circumstances make the goal unrealistic.

Time-bound

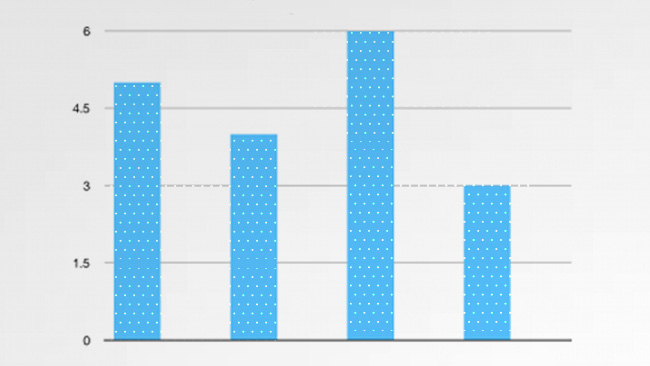

Setting a deadline adds a whole new layer of responsibility: now the goal has to be completed within a concrete time frame. We can take a goal like “I need to sell 10% more products” and add “by the end of this quarter” — and the goal suddenly becomes real because it has a fixed point in time. A time restraint also optimizes the way you work on the goal, encouraging to divide the process into smaller windows and think what can be done this day, this week, this month.

However, just like the “Measurable” criterion, it’s totally normal to change the time constraints if something unexpected happens (failing to meet a deadline, no matter how frequent, is always unexpected)

Goals can help you succeed — but they have to be: a) right for you and b) set correctly. We hope that the knowledge we’ve explored will make your life better. We’re open for comments & feedback 24/7 in our comment section — and our share button also works tirelessly to spread our posts, so don’t hesitate to press it. 😉